Moore Accountancy Covid-19 Support update

There are regular updates on what support and initiatives have been given to individuals and businesses in the UK on the back of the Covid-19 pandemic.

Below is a summary of what current information is available, and we are working hard to ensure this guidance is up to date – however you should bear in mind that things may change on a daily basis as the Government respond to the ongoing situation.

Please bookmark this page for your reference to return to, in a few days. (updated 01/06/2020)

ALL BUSINESSES

Deferral of VAT payments

- Covers all VAT registered businesses

- Can defer VAT payments due between 20/03/20 and 30/06/20 until the end of the tax year (i.e. March 2021), so should apply to one quarters VAT return.

- Automatic offer with no applications required. Businesses will not need to make a VAT payment during this period, but will still need to submit a return as usual.

- Customers who normally pay by direct debit should cancel their direct debit with their bank if they are unable to pay. Please do so in sufficient time so that HMRC do not attempt to automatically collect on receipt of your VAT return.

Time to pay arrangements (TTP)

- This is an existing scheme but HM Treasury now have a specific phone line.

- This scheme allows a business to defer current tax debts, by setting up a 3-12 month payment scheme.

- HMRC have made it clear that they see themselves as lender of last resort and will expect demonstration that all other finance support options have been pursued first.

- gov.uk/difficulties-paying-hmrc

- Try calling 0800 0159 559 or 0300 200 3835 to speak to HMRC

Companies filing extension

- Companies can apply for a 3 month extension to file their accounts.

- Applications will need to be made via a fast tracked online system see link here

SMALL BUSINESSES

Coronavirus business interruption loan scheme (CBIL)

- CBILS is a scheme that can provide facilities from £1k up to £5m for smaller businesses who are experiencing lost or deferred revenues, leading to disruptions to their cashflow.

- Maximum turnover of business is £45m

- The first 12 months is interest free

- Banks are now banned from demanding personal guarantees on loans under £250,000 (updated 05/04/20)

- https://www.british-business-bank.co.uk/ourpartners/coronavirus-business-interruption-loan-scheme-cbils/

Bounce Back Loan Scheme for small business (updated 27/04/20)

- SME loans of up to £50,000 (or 25% of business turnover) available from 04/05/20

- 100% of the loan guaranteed by the Government and should be payable within 24 hours of approval.

- Loan terms of up to 6 years, with no repayment in the first 12 months. Interest will accrue after that

- You can not apply if you have already received funds via CBILS (see above scheme)

- Guidance available here

Rates relief for smaller businesses (SBGF)

- Additional funding for Local Authorities to provide one off grant of up to £10k for businesses currently already receiving the small business rate relief (SBRR) to help meet ongoing costs.

- This is taxable income and will need to be disclosed in your accounts and tax returns. (updated 18/05/20)

- Your LA should contact you directly, but please contact them if you feel you are entitled to this but have not heard anything.

LA Discretionary Fund Scheme (updated 07/05/20)

- Discretionary funding for Local Authorities to provide grants to local businesses which did not meet the eligibility criteria for the SBGF or the Retail, Hospitality and Leisure grants.

- Focus on small and micro businesses with relatively high ongoing fixed property related costs – with priority for shared offices, flexible workspaces, market traders, certain B&Bs amongst others

- Guidance for the new scheme is here

Retail, hospitality and leisure businesses

- £25k taxable grant provided to businesses operating from smaller premises, with a rateable value between £15k and £51k

- Funding will be provided by Local Authorities

- 100% business rates discount, with no limit on rateable values.

- https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/873622/Expanded_Retail_Discount_Guidance.pdf

EMPLOYERS

Job Retention Scheme (JRS)

- See our updated blog post here on updates to the Job Retention Scheme from August 2020 –

- Covers any business, charity or non profit organisation that runs a PAYE scheme – https://www.businesssupport.gov.uk/coronavirus-job-retention-scheme/

- Covers up to 80% of salary (max £2.5k pcm), plus the associated Employer National Insurance contributions and minimum automatic enrolment employer pension contributions on that wage, of anyone not working, but retaining a job (i.e. not been P45d). The employees will need to be reclassed as “furloughed”.

- These furloughed employees should not undertake any work including answering calls or emails, and you will need to communicate in writing with employees about what being furloughed means and why it is happening.

- Wages can be backdated to 1/3/20 and has been extended to October 20. (updated 13/05/20)

- From August, new flexibility will be introduced, allowing furloughed workers to be able to return to work part-time with employers being asked to pay a percentage towards the salaries. The Chancellor has said that the employer payments will substitute the contribution the government is currently making, ensuring that staff continue to receive 80% of their salary, up to £2,500 a month. More specific details and information around its implementation will be made available by the end of May. (updated 13/05/20)

- An employee can be furloughed for a minimum of 3 weeks. If work comes in, then employees can be taken off furlough to perform work and then re-furloughed for a minimum of 3 weeks again. (updated 31/03/20)

- Will be a taxable grant, not a loan but appears to be a reimbursement by HMRC of salary costs paid to these furloughed employees, so there will be a temporary cash flow issue

- For some simple questions and answers see the attached document from Knights plc

- For details on calculations and the basis of the payment to staff read – https://www.gov.uk/guidance/claim-for-wage-costs-through-the-coronavirus-job-retention-scheme (updated 27/03/20)

- The basis in summary is the higher of the same month’s earnings from the previous year or the average monthly earnings from the 2019-20 tax year. (updated 31/03/20)

- Directors – can be furloughed but only statutory duties can be carried out – no services or revenue-generating work (this only applies to the PAYE salary, not dividends)

- This has been open now since 20/04/20. You will need to log on via your government gateway and choose PAYE and then make a manual submission. There is a HMRC calculator which can be used as a guide and the claim guidance is provided here .

Statutory sick pay (SSP)

- Previously, SSP was payable to employees after the 3 day waiting period, and any SSP paid by an employer was not recoverable.

- SSP is now payable to qualifying employees for those who are self isolating due to being vulnerable or living in a household with a with some displaying symptoms, or unwell themselves, due to COVID-19, from day 1. This applies to those employees earning at least at an average of £118pw (£120pw from 6/4/20)

- The cost of SSP (£94.25 pw) can be recovered by employers with less than 250 employees, for a maximum of 2 weeks sickness per employee.

- If staff can not take their full annual leave entitlement now, they can carry it over the next two years.This holiday cannot be replaced with a payment in lieu unless the worker is leaving employment.(updated 31/03/20)

- The Government have not yet stated what the mechanism will be for this, but it may be via your usual monthly payroll submissions. We suggest all employers need to keep a log of sickness due to Covid-19 in anticipation. Updated guidance is here.

SELF EMPLOYED

Deferral of SATR payments

- Covers self employed and partnerships

- Any 2nd payments on account due on 31/07/20 will be payable with any balancing adjustment in January 2021

- This is an automatic offer with no applications required.

- No penalties or interest for late payment will be charged in the deferral period.

Self-employment Income Support Scheme (CSEISS)

- UPDATED – a second grant will be available in August, being 70% of the average monthly trading profits, and capped at £2,190pcm or £6,570 in total. (updated 01/06/20)

- 80% of “monthly wages” covered by the Government, for those who are already self-employed and have a SATR for 2019

- Calculated using average monthly profits over the last 3 financial years, but limited to those with trading profits up to £50k a year

- Support will be capped at £2.5k pm, and will initially last for 3 months

- Applies for those individuals where over 50% of income comes from self employment.

- Self employed will be able to receive the taxable lump sum, no later than June; but this will cause cashflow issues in the meantime

- Have a read of our FAQ update here – SELF-EMPLOYMENT INCOME SUPPORT SCHEME (CSEISS) – guidance

- Current guidance is here – https://www.gov.uk/guidance/claim-a-grant-through-the-coronavirus-covid-19-self-employment-income-support-scheme

- HMRC should have contacted those affected by now (middle of May), with monies to be paid out within a week of application. Look out for correspondance and start collating your taxable profits (using SA302 tax summaries) now ready for the application. (updated 13/05/20)

Extension of 2018/19 filing deadline

- If you have not filed your 2018/19 SATR yet, the government have extended the deadline temporarily to 23/04/20

- Penalties for late filing and late payment of tax will apply as normal.

INDIVIDUALS

- The Universal Credit standard allowance is increasing by £1k pa for the next 12 months – https://www.litrg.org.uk/tax-guides/tax-credits-and-benefits for general guidance on tax credits

- The Working Tax Credit basic element is increasing by £1k pa for the next 12 months

- A suspension of the minimum income floor for the self employed has been agreed

- Consider claiming employment support allowance (ESA) if you have paid enough NIC contributions over the last 2-3 years, and are not entitled to SSP

- Apply for a mortgage holiday for up to 3 months from your provider

- Look at www.moneysavingexpert.entitledto.co.uk/home/start for a quick benefits checker tool.

- Please read the Universal Credit (UC) guide – Universal Credit Factsheet to help you understand the options and eligibility

- The income tax deferral for self-employed has now been extended to anyone who has a July 2020 payment on account (updated 30/03/20)

RESOURCES

- Government main page – https://www.gov.uk/government/publications/guidance-to-employers-and-businesses-about-covid-19/covid-19-support-for-businesses

- ACA webinar for employers – https://www.acas.org.uk/webinars

- Government’s Business Support Helpline – 0300 456 3565 or 0800 998 1098

- Governments’ Business Support page – https://www.businesssupport.gov.uk/coronavirus-business-support/

- Peninsula “my coronavirus toolkit” – which has handy pdfs to download – https://www.peninsulagrouplimited.com/covid-19-toolkit/

- Our local insolvency practitioner also has a useful page with information for businesses – http://www.lucasjohnson.co.uk/covid-19/

- We are members of the 2020 Accountants Group – who have also created a source of information here – https://www.the2020group.com/2020-client-resources/

News

Nobody likes a brown envelope from HMRC, especially one containing [...]

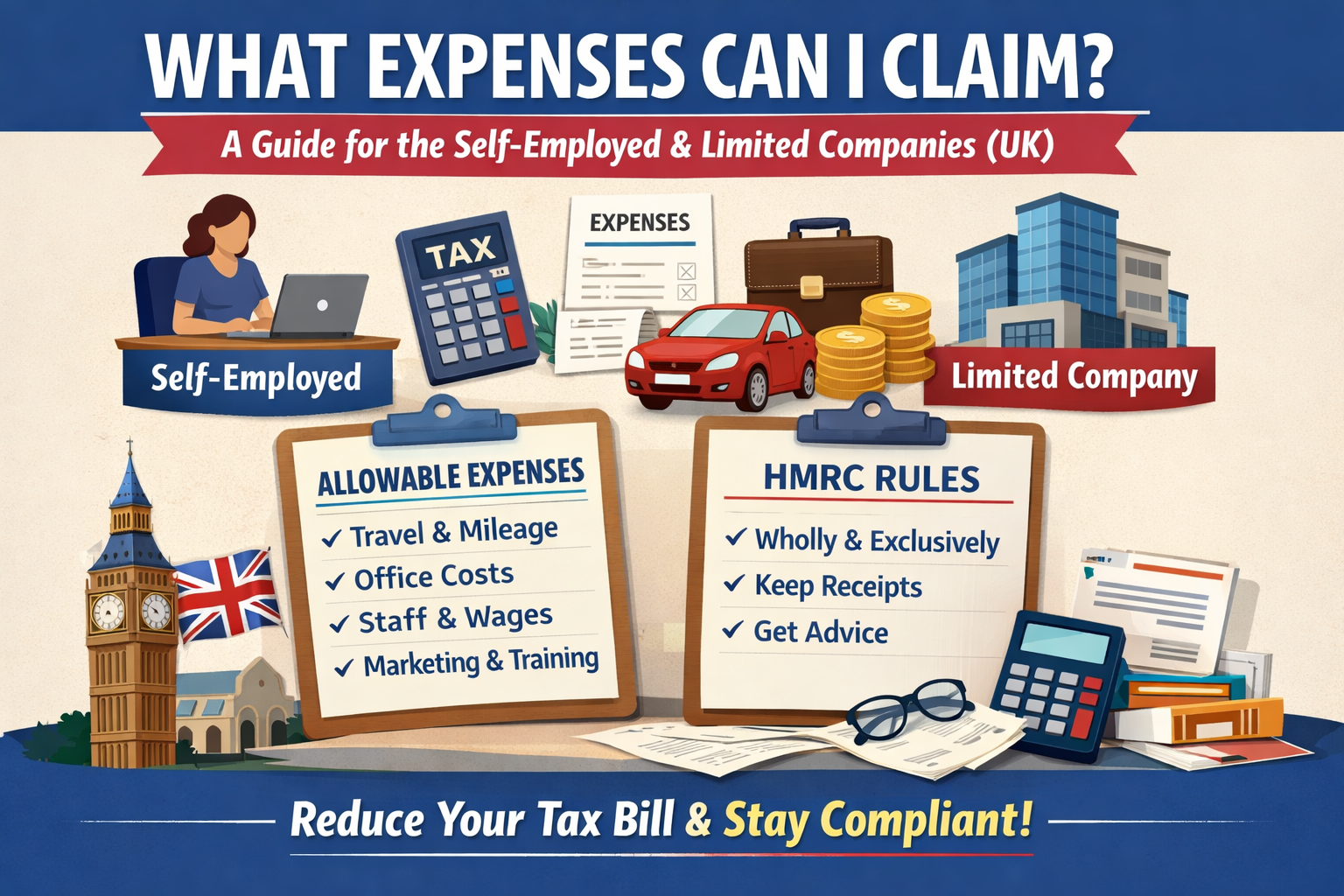

What Expenses Can I Claim? A Guide for the Self-Employed [...]

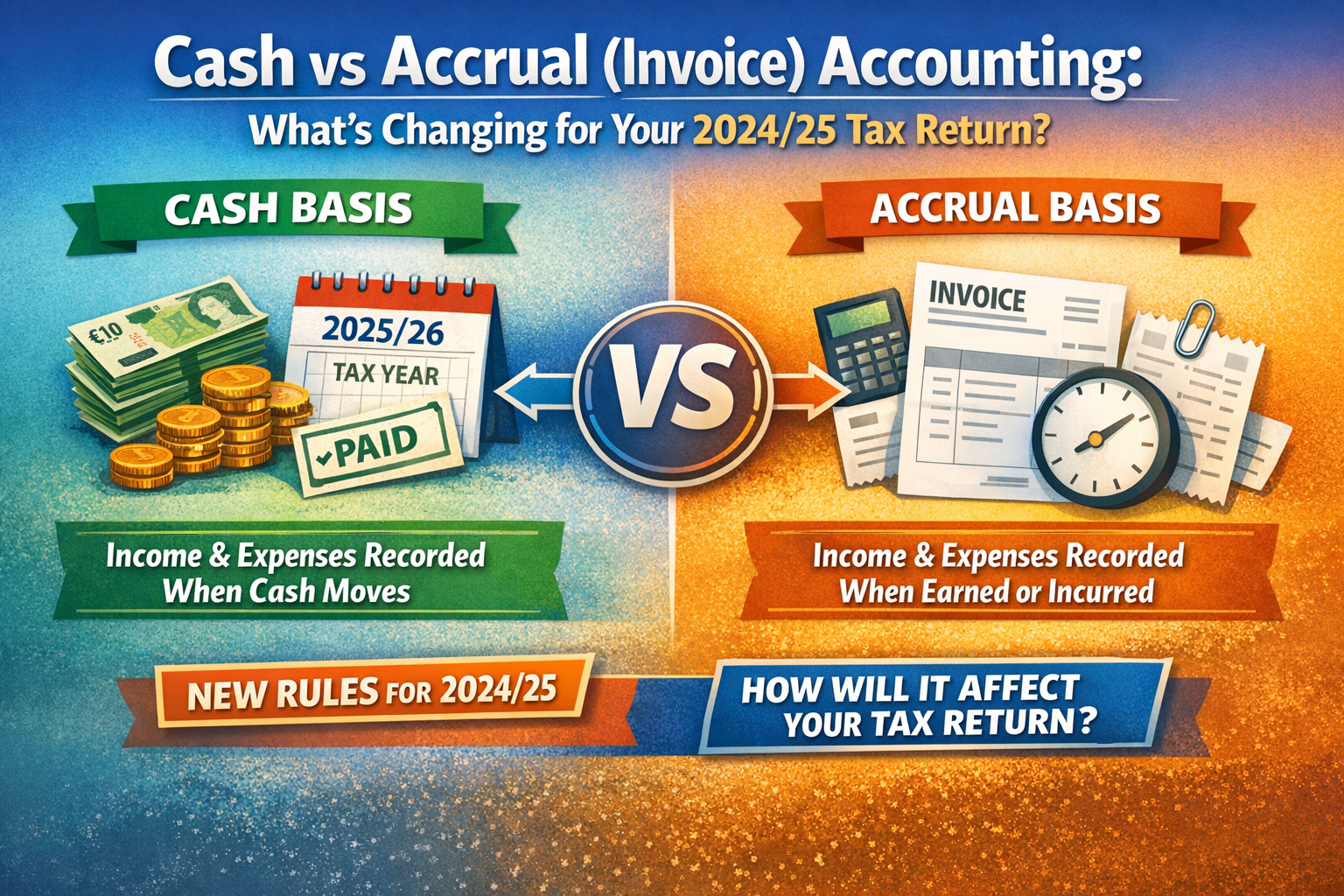

Cash vs Accrual (Invoice) Accounting: What’s Changing for Your 2024/25 [...]

On 26/11/25, Chancellor Rachel Reeves presented her second Budget to [...]

Understanding Payments on Account: What You Need to Know [...]