Auto Enrolment Services

Auto Enrolment (AE) has been brought in by the Government to ensure more employees are planning and saving for their retirement needs and the attachments below provide more information as to what we can do and how our pricing structure works.

Auto Enrolment (AE) has been brought in by the Government to ensure more employees are planning and saving for their retirement needs and the attachments below provide more information as to what we can do and how our pricing structure works.

This means all employees who earn over a certain threshold are required to be auto-enrolled into a pension scheme organised by the company they work for. We are here to help you understand the requirements for Auto-Enrolment.

There are three categories of workers: eligible jobholders; non-eligible jobholders; and entitled workers and when you supply your payroll data we can provide a report to see which category your staff fall in to.

Eligible jobholders for whom automatic enrolment will be required are those who:

- Are aged between 22 years and the State Pension Age (SPA – see www.gov.uk/calculate-state-pension)

- Have qualifying earnings above the earnings trigger for automatic enrolment (this will remain at £10,000 for 2017/18)

- Are working or ordinarily working in the UK

- Are not already members of a qualifying pension scheme.

Minimum Contributions

From the company’s staging date, employers will be required to pay regular contributions into their staff pension scheme for staff who have been automatically enrolled or who have opted in. The table below shows the minimum amounts the employer will need to pay.

| DATE | EMPLOYER MINIMUM CONTRIBUTION | TOTAL MINIMUM CONTRIBUTION |

|---|---|---|

| Before 05/04/18 | 1% | 2% (incl. 1% staff contribution) |

| 06/04/18 – 05/04/19 | 2% | 5% (incl. 3% staff contribution) |

| 06/04/19 onwards | 3% | 8% (incl. 5% staff contribution) |

For any new payroll schemes being set up with HMRC, Auto Enrolment duties take immediate effect, so it is important to be aware of your extra liabilities and obligations.

Click here to download the services which Moore Accountancy can provide relating to Auto Enrolment for our Payroll Bureau clients: Moore Accountancy AE services

Click here for an Auto Enrolment checklist which may help you on your compliance journey: Moore Accountancy AE services checklist

Note the prices for Auto Enrolment are in addition to our normal payroll fees and VAT is applicable at the current rate.

News

Nobody likes a brown envelope from HMRC, especially one containing [...]

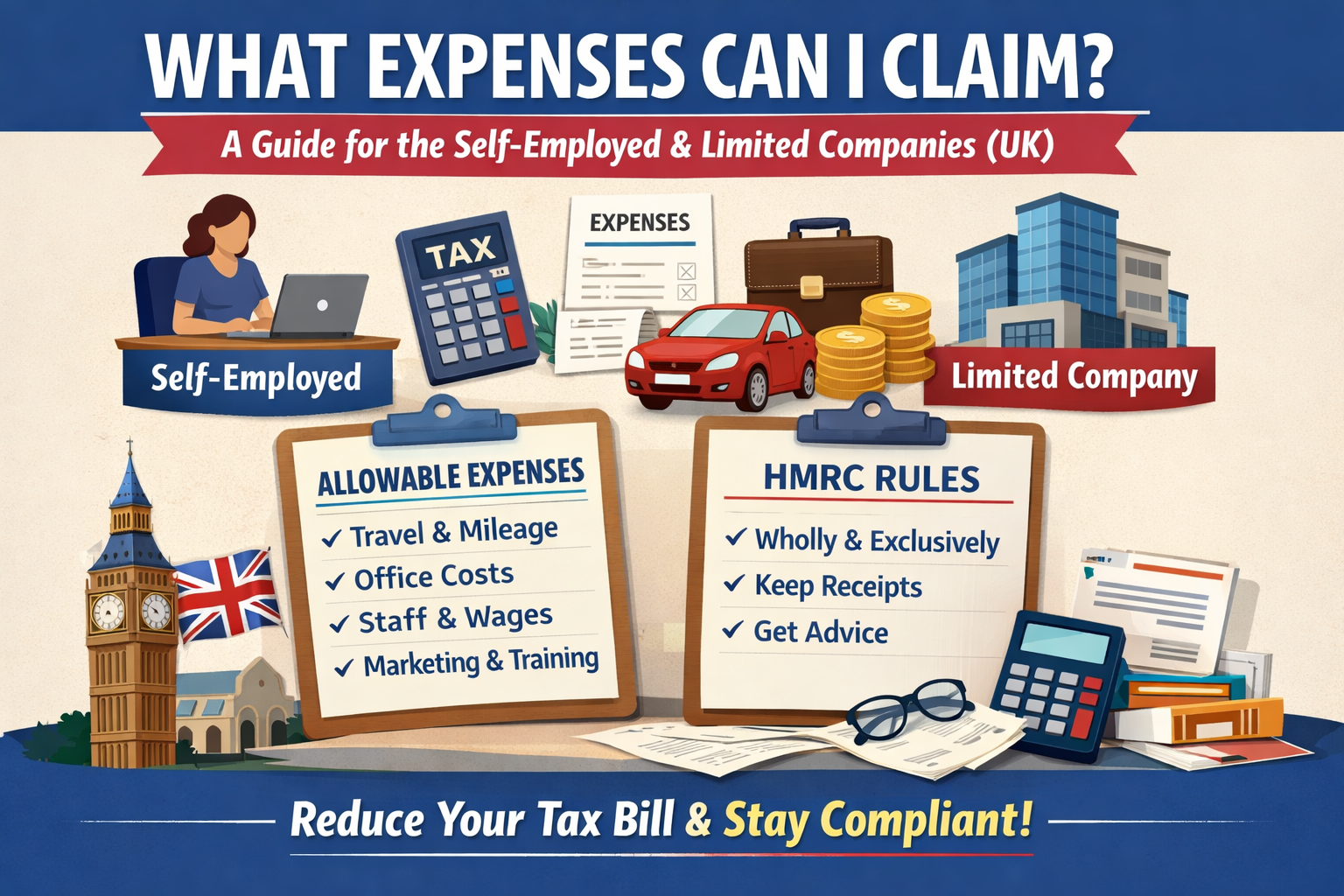

What Expenses Can I Claim? A Guide for the Self-Employed [...]

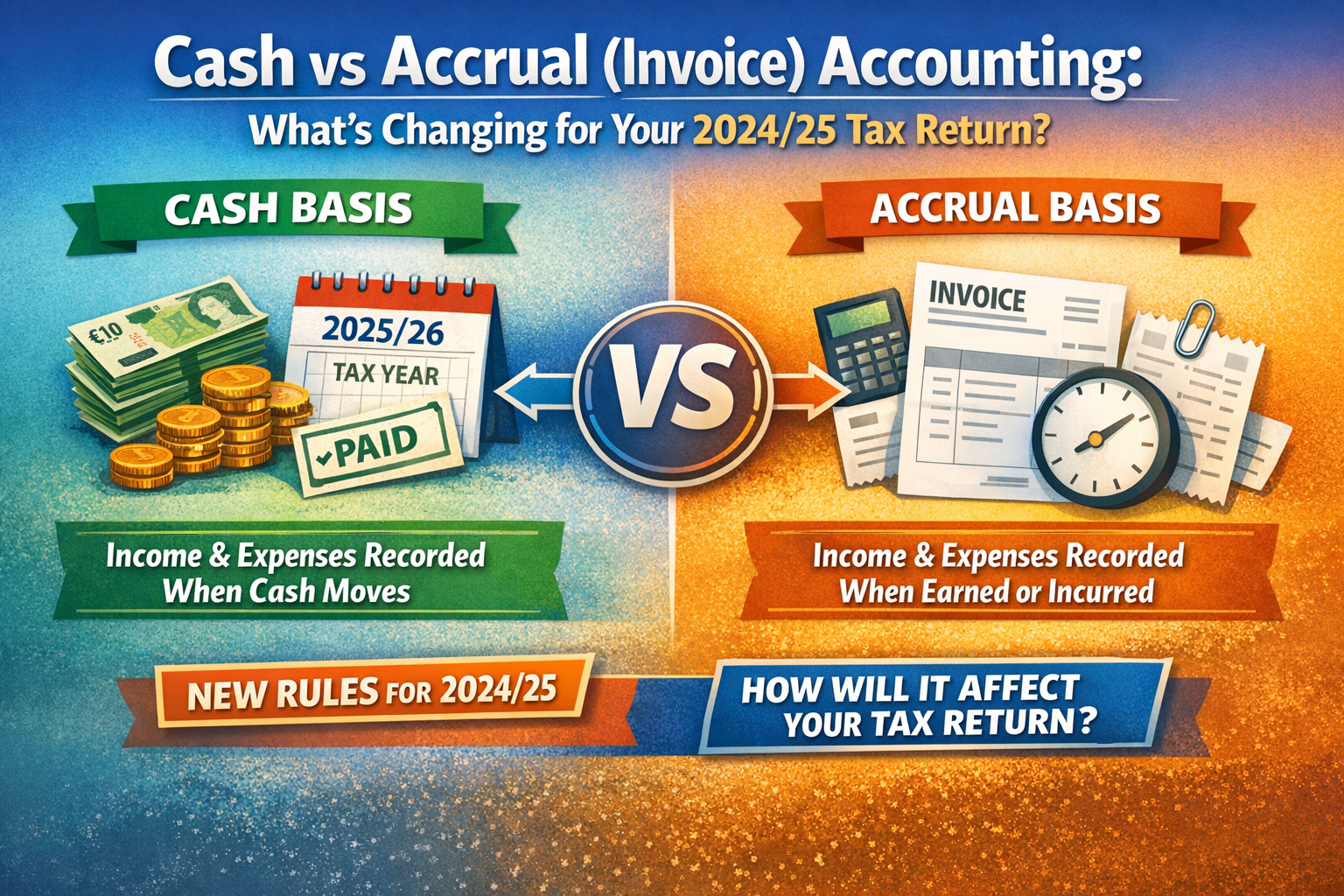

Cash vs Accrual (Invoice) Accounting: What’s Changing for Your 2024/25 [...]

On 26/11/25, Chancellor Rachel Reeves presented her second Budget to [...]

Understanding Payments on Account: What You Need to Know [...]