Making Tax Digital (MTD) – more detailed information

Summary

MTD for VAT is the first major phase in the Making Tax Digital (MTD) initiative– the government’s plan to make tax administration more effective, more efficient and easier for taxpayers through the introduction of a fully digital tax system.

VAT-registered businesses with turnover above the VAT threshold of £85K will be required to digitally record their bookkeeping and submit VAT returns using MTD-compliant accounting software. This change will start from the 1st April 2019.

See our earlier blog for a brief overview of MTD.

The key benefits:

- No more tax return chaos – making sense of 12 months’ worth of receipts, invoices and transactions removed by submitting data quarterly which will be so much more manageable.

- Increased control – quarterly updates will allow you and your clients to keep track of their end of year tax bill

- Time saving – moving towards automated systems saves time and reduces unnecessary errors caused by repeated data entry.

No changes are being made to:

- The underlying VAT rules.

- The amount of information required to be submitted to HMRC; the VAT return will contain the same nine boxes that it does currently though the regulations do allow for additional information to be submitted on a voluntary basis.

- The current filing and payment deadlines for VAT.

Process

HMRC’s online VAT portal will close from April for compulsorily VAT registered businesses; VAT returns must instead be submitted to HMRC through MTD software and businesses must digitally record their VAT transactions and returns using MTD software.

Business will have to maintain their accounting records digitally in a software product or spreadsheet. Maintaining paper records will cease to meet the legal requirements in tax legislation. The digital records held must be able to connect to HMRC’s systems via an Application Programming Interface (API). The software must be able to:

- Keep the required records in a digital form;

- Preserve those records in digital form for up to 6 years;

- Create a VAT return from the digital records

- Provide HMRC with this information digitally;

- Provide HMRC with additional data on a voluntary basis.

- Receive information from HMRC about the business’s compliance record.

Technology

All VAT returns will have to be filed through HMRC’s new MTD interface that enables accounting systems to communicate with HMRC’s systems instead of through the existing portal.

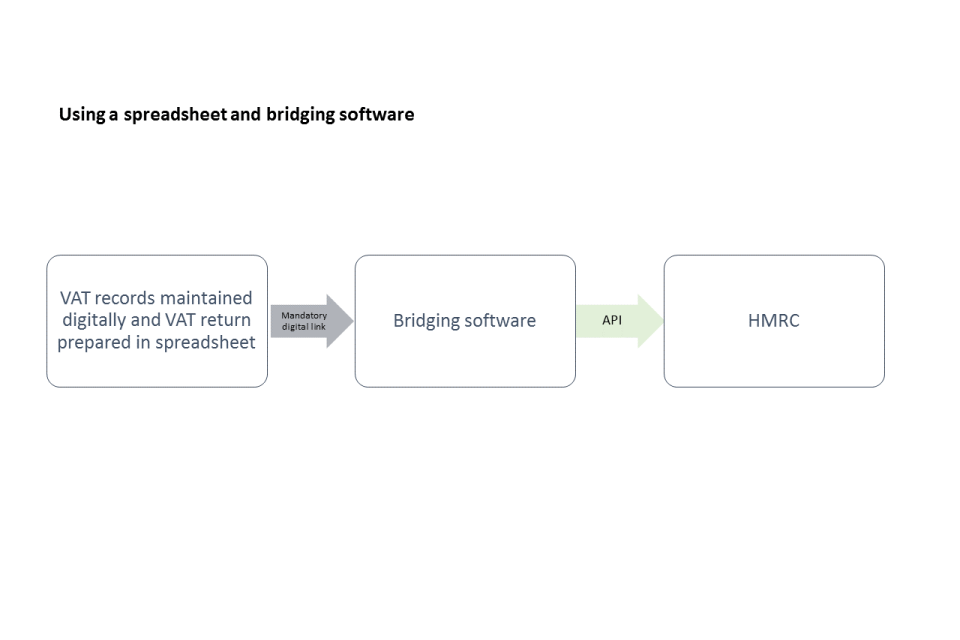

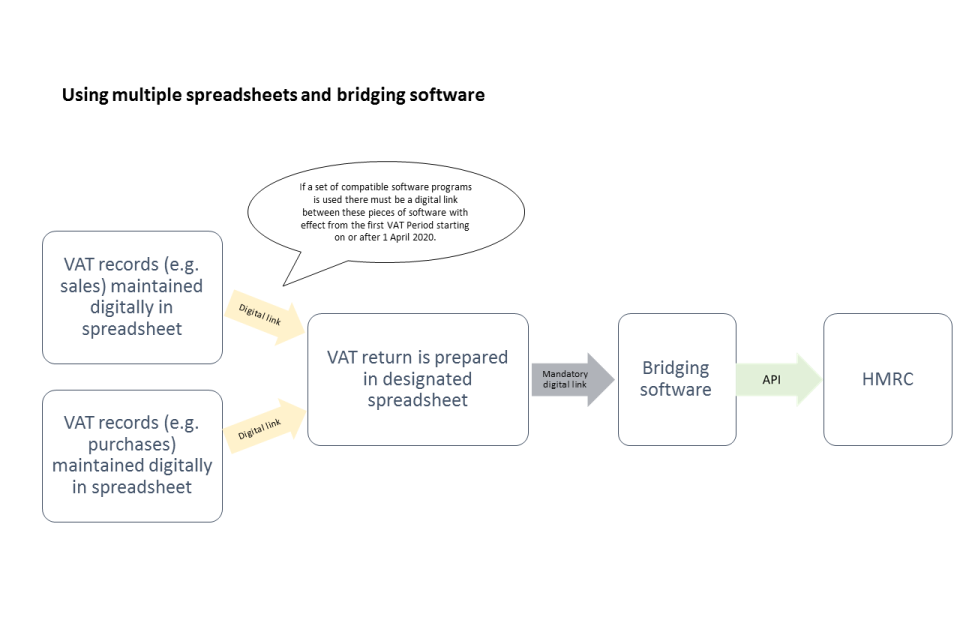

Digital records can be maintained in more than one program or software product. The use of spreadsheets, either to record individual transactions or as part of a suite of software and spreadsheets is permitted. However, the spreadsheet will need to be either API enabled or used in combination with an MTD compatible software product so that data can be sent to and received from HMRC systems; an existing spreadsheet alone is not a free way to comply with the MTD for VAT requirements.

Where the records are maintained in more than one program or product there must be digital links between each of the pieces of software. Information cannot be transferred manually between products. Digital links have been defined and the following actions are included:

- emailing a spreadsheet containing digital records to a tax agent so that the agent can import the data into their software to carry out a calculation (for instance, a Partial Exemption calculation);

- transferring a set of digital records onto a portable device (for example, a pen drive, memory stick, flash drive) and physically giving this to an agent to import that data into their software;

- XML, CSV import and export, and download and upload of files;

- automated data transfer;

- API transfer; or

- linked cells within or between spreadsheets. The transfer of information by the use of copy and paste or cut and paste does not meet the requirement for a digital link

For the first year, HMRC will not enforce the requirement to have digital links in place. This is to allow some more time for links between legacy systems to be made digital.

Time table and what’s next? **

Businesses need to look at their current bookkeeping processes and see if it already complies with MTD, can be amended to utilise “bridging software” in the short term, or needs to be moved to a cloud accounting product.

Moore Accountancy will be writing to all affected clients over the next few months but please keep an eye on our website and newsletters in the interim as we work to find the best options for you.

** These are the current dates but may change in the future should HMRC or any other public body notify us.

Making Tax Digital

From April 2019 Making Tax Digital (MTD) requires all VAT registered businesses with a turnover over the VAT threshold (currently £85,000) to submit their VAT returns digitally using only MTD compatible software. HMRC have also stated that business will no longer be able to use the current free VAT online portal for submitting their tax returns.

For those who are imminently affected by HMRC’s MTD scheme, it is time to look what changes, if any, have to be made to their accounting processes. Businesses with a taxable turnover below the VAT threshold will not have to operate MTD but can still choose to do so voluntarily.

Moore Accountancy deal with many different clients with different systems and processes, we are here to provide help and guidance to ensure that this important deadline is not missed.

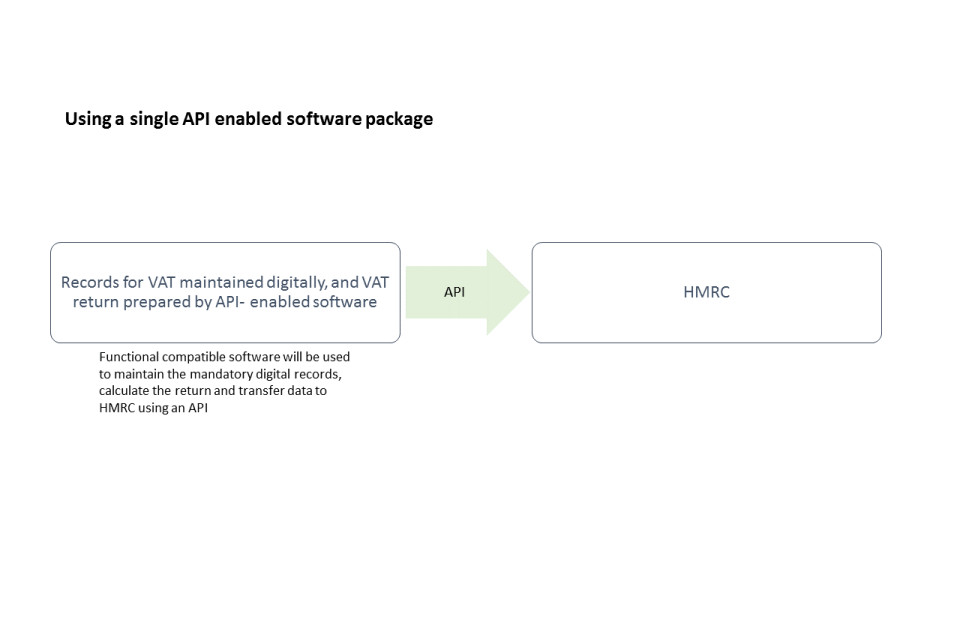

Business’s that use a single functional compatible software package like Xero, Clearbooks or VT are already MTD compliant and will notice very little change to their VAT tax return as long as they use a single software product to record all sales, purchases, and expenses in a digital format. The software must have the necessary functionality to maintain the mandatory digital records, prepare the VAT Return, and submit this to HMRC via an API. In this situation, all data transfer must be digital.

For those businesses that rely on spreadsheets, legacy software or paper accounting there will need to be changes made but the HMRC’s aim is to deliver a modern, digital tax system for all businesses and their agents supporting them to get their tax right and reducing the amount of tax lost through avoidable error.

The diagrams below model two common workflows,

HMRC has been working closely with software providers to help them to bring a wide range of MTD products to market, and has published a list on GOV.UK of those that are already at the stage of having demonstrated a prototype product ready to start testing with businesses and/or agents.

The software available varies hugely in price and functionality. For a client who is looking to become HMRC MTD compliant with the minimum of fuss and cost then Absolute Excel VAT filer would be a good place to start looking. They provide a simple MS Excel solution which can be seen in the following short demo: https://www.youtube.com/watch?v=04ec7XY4b8U.

There is a lot of information to take on board and Moore Accountancy are available to discuss the options and potential costs with you – so get in touch if this affects you.

News

On 06/03/24 Chancellor Jeremy Hunt presented his Spring Budget to […]

Companies House have stated that they will be increasing their […]

On 22/11/23 Chancellor Jeremy Hunt presented his Autumn Statement to […]

The trend towards digital paperless office solutions is rapidly increasing, […]

The VAT Flat Rate scheme (FRS) was introduced in 2002 […]