What are payments on account and why do I need to pay them?

Understanding Payments on Account: What You Need to Know

If you’ve received a tax calculation and spotted something called “Payments on Account”, you’re not alone. Many clients contact us each year asking why HMRC is asking them to pay tax in advance and whether they actually need to.

These payments can come as a surprise, especially if it’s your first year in self-assessment, but the system is straightforward once you know how it works. Here’s a clear breakdown of what payments on account are, why they exist, and what this means for you.

What Are Payments on Account?

Payments on account are advance payments towards your next tax bill. They apply to individuals who pay tax through self-assessment — such as sole traders, landlords, and anyone whose income isn’t automatically taxed through PAYE.

In short, instead of paying everything in one lump sum each January, HMRC asks you to spread the cost over two instalments.

Why Is HMRC Asking for This?

Because your income isn’t taxed automatically throughout the year, HMRC uses payments on account to make sure you’re staying on track with what you owe. This also helps prevent a much larger, unexpected bill building up.

You’ll be required to make payments on account if:

- Your last tax bill was over £1,000, and

- Less than 80% of your tax was collected through PAYE.

If both apply, HMRC will automatically include these advance payments within your bill.

How Do Payments on Account Work?

Payments on account are based on your previous year’s tax bill and are split into two equal instalments:

- 31 January – first payment on account (50%)

- 31 July – second payment on account (50%)

When you submit your next return:

- If you owe more than you’ve already paid, you’ll pay the difference in the following January (this is called the balancing payment).

- If you’ve overpaid, HMRC will offset the difference against your next payment on account.

An Example

If your 2023/24 tax bill is £2,000, HMRC will assume your 2024/25 bill will be similar. You would pay:

- January 2025: £2,000 for 2023/24 plus £1,000 (first payment on account for 2024/25)

- July 2025: £1,000 (second payment on account for 2024/25)

By the time you come to file for 2024/25, you’ve already paid £2,000 towards that year.

Can You Reduce Your Payments on Account?

If you expect your income to be lower next year, you may be able to reduce these payments. However, this must be done carefully — if you reduce them too far and underpay, HMRC will charge interest.

If you’re unsure, we can help review your figures before you make any changes.

What This Means for Our Clients

If you’re self-employed, rent out a property, or have other income outside PAYE, payments on account may apply to you. When they do, we’ll highlight this clearly in your tax calculation and explain what’s due and when.

If any part of your bill doesn’t look right, or if you’re unsure why these amounts have appeared, please get in touch — we’re always happy to talk it through.

Need Some Help?

Whether you’re unsure why HMRC is charging payments on account or want to check if yours can be reduced, just let us know. We’re here to support you and help make the process as smooth as possible.

info@mooreaccountancy.co.uk

0161 470 7878

News

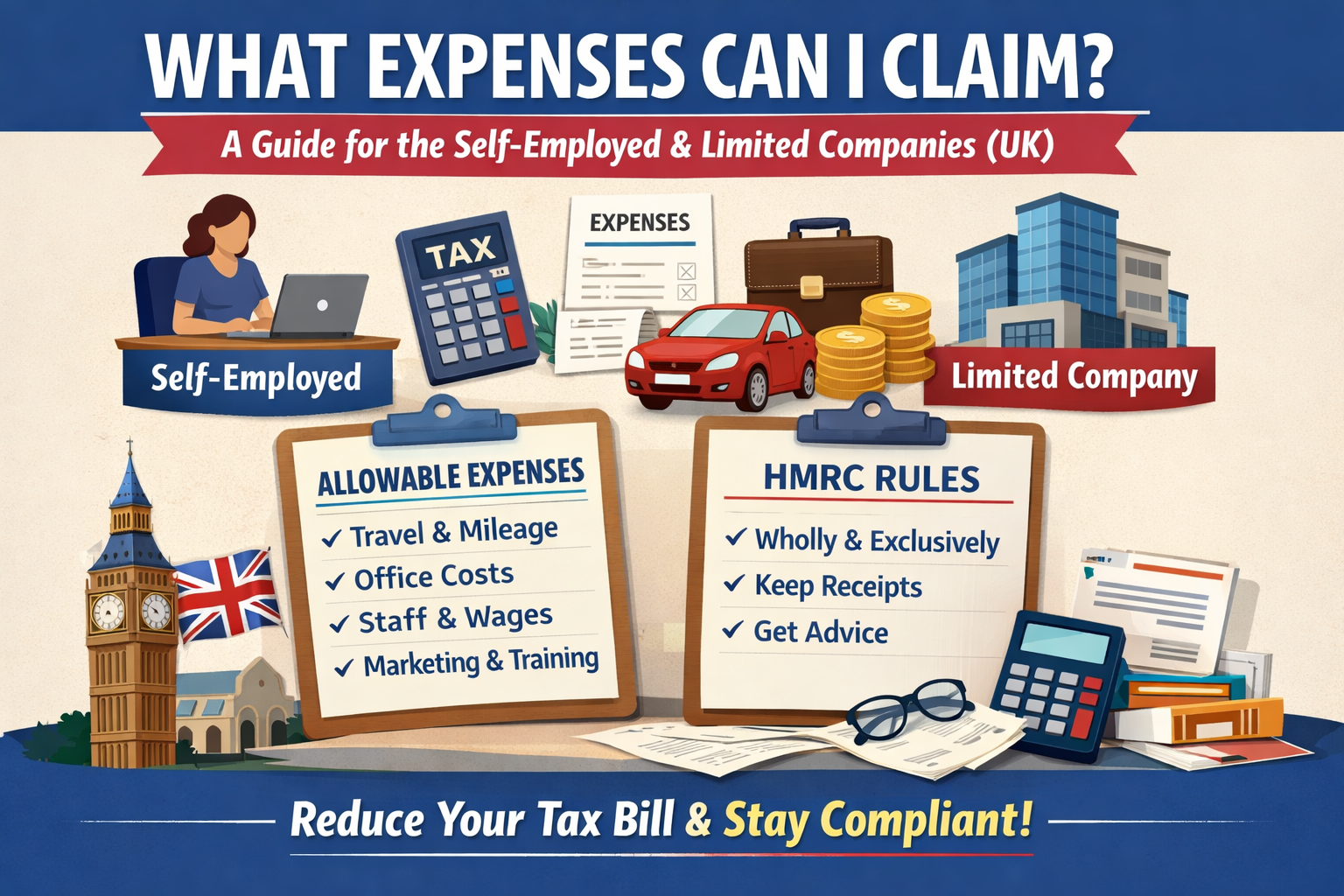

What Expenses Can I Claim? A Guide for the Self-Employed [...]

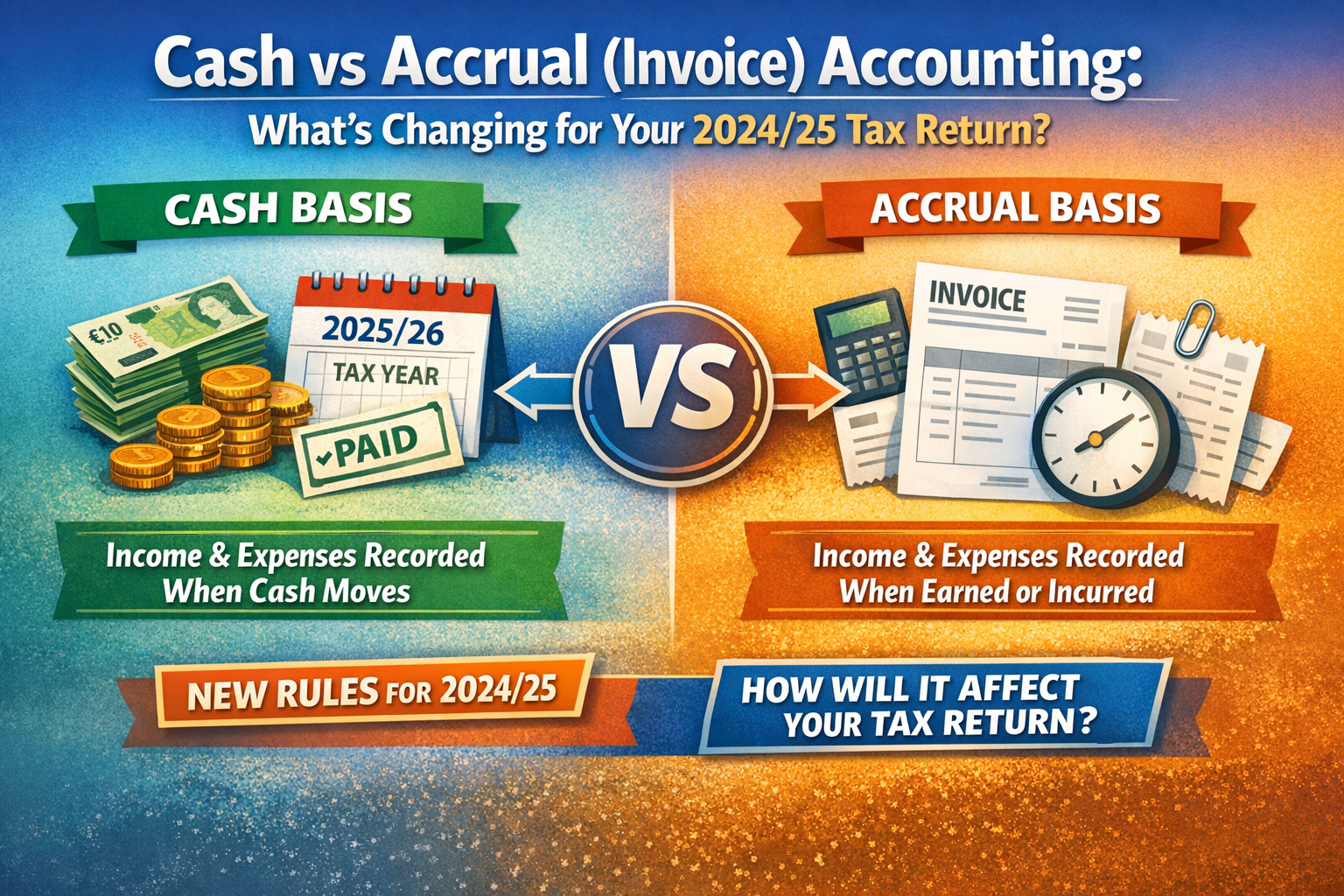

Cash vs Accrual (Invoice) Accounting: What’s Changing for Your 2024/25 [...]

On 26/11/25, Chancellor Rachel Reeves presented her second Budget to [...]

Understanding Payments on Account: What You Need to Know [...]

At Moore Accountancy, we work with many landlords—some who hold [...]