Do I need to submit a Self-Assessment Tax Return?

Do I need to submit a Self-Assessment Tax Return?

You must register and file a SATR if you fall under any of the following categories:

- are self-employed as a sole trader, and earned more than £1,000

- are a landlord with gross rental income over £1,000

- earned more than £1,000 in untaxed income, such as tips or commission

- made over £3,000 in profit from investments or other capital disposals

- received more than £10,000 from (non ISA) savings interest or dividends

- have PAYE income over £150,000

- If you or your partner earns over £60,000 and claim child benefit you must pay high income child benefit charge and submit a self-assessment return

- are a director of a company and taking dividends

- earn over £50,000 and make pension contributions which are not under a salary sacrifice or net pay arrangement

- receive state pension which was more than your personal allowance, and is your only source of income

- receiving income from a trust or settlement or any income from the estate of a deceased person and further tax is due on that income

- have foreign income

- want to claim a tax refund (CIS, EIS, SEIS, donations)

- live abroad and had income from the UK

- are in a partnership

- are a minister of any religion

- have been told by HMRC to submit one

If you are unsure, please check online here.

How to register and send a return?

If you need a tax return but do not have a unique tax reference (UTR), you must register for Self Assessment by 05/10.

Once you have registered as self employed, or not self employed but receiving other income, then you will be issued with a UTR from HMRC.

The next step is to set up a Government Gateway account to give you access to your taxes online.

Note if you wish Moore Accountancy to file your SATR for you, we will request agent access, and will never ask for or use your government gateway login details, as these are personal to you.

Penalties

If you fail to register by 5/10, fail to file a paper return by 31/10, fail to file online by 31/1 or fail to pay your tax liability by 31/1, then you may be charged a penalty fee.

Interest is charged on both unpaid tax and penalties

If your return is filed 3 months late, the penalty is £100, and this increases as per the table below:

| Late filing | Late payment | Penalty |

| Missed filing deadline | £100 | |

| 30 days late | 5% of tax due | |

| 3 months late | Daily penalty £10 per day for up to 90 days (max £900) | |

| 6 months late | 5% of tax due or £300, if greater (NB the sum of 6m and 12m penalties should not exceed 100% of tax due) | |

| 6 months late | 5% of tax outstanding at that date | |

| 12 months late | 5% or £300 if greater, unless the taxpayer is held to be deliberately withholding information that would enable HMRC to assess the tax due. (NB the sum of 6m and 12m penalties should not exceed 100% of tax due) | |

| 12 months late | 5% of tax outstanding at that date | |

| 12 months & taxpayer deliberately withholds information | Based on behaviour:

Reductions apply for prompted and unprompted disclosures and telling, giving and helping. It is therefore better to inform HMRC than them finding you! |

Use this interactive link from HMRC to calculate what penalties can accrue – https://www.gov.uk/estimate-self-assessment-

If you need to file a tax return based on the requirements above then please contact us at info@mooreaccountancy.co.uk or 01614707878 to obtain a personalised quote for providing tax return services.

News

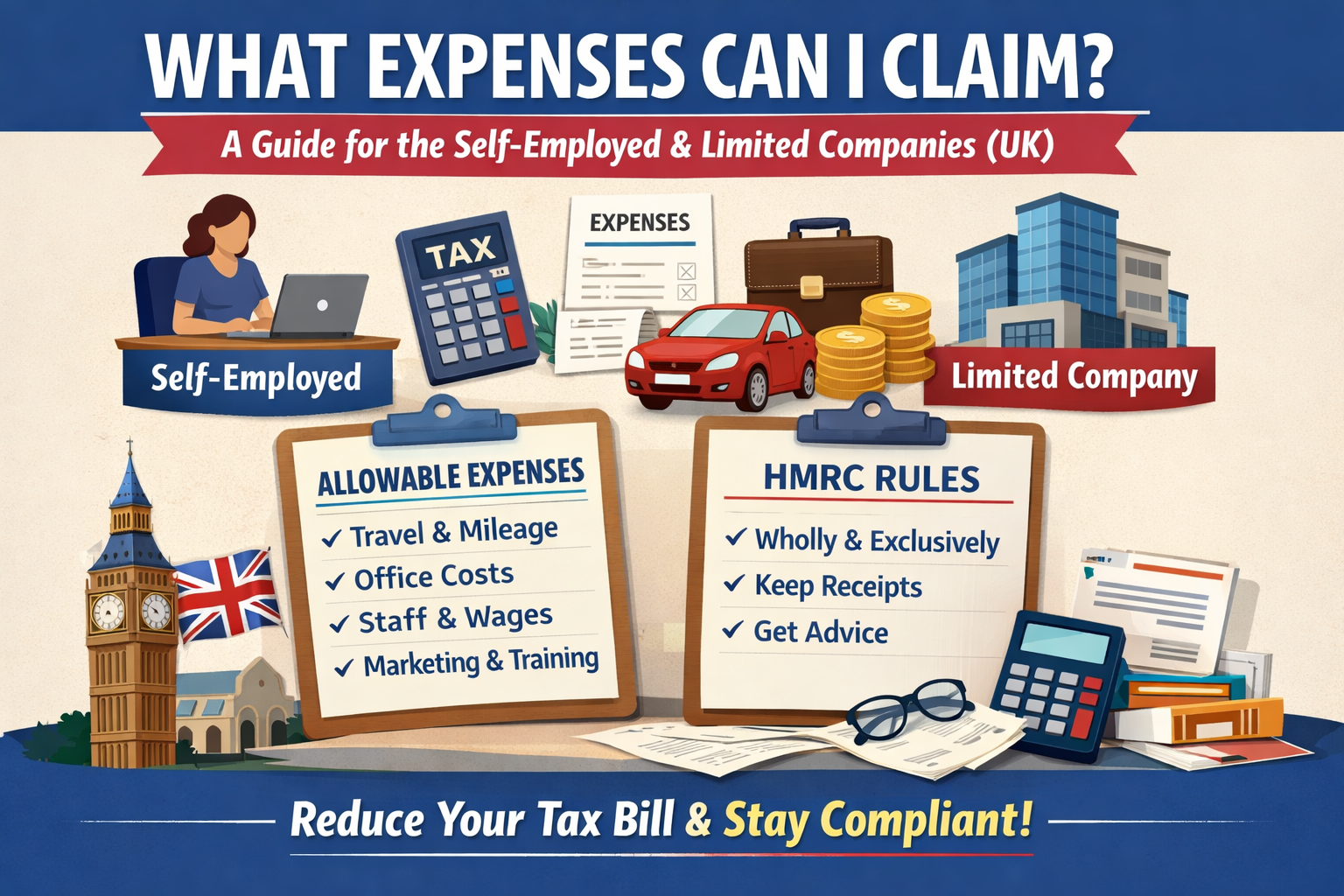

What Expenses Can I Claim? A Guide for the Self-Employed [...]

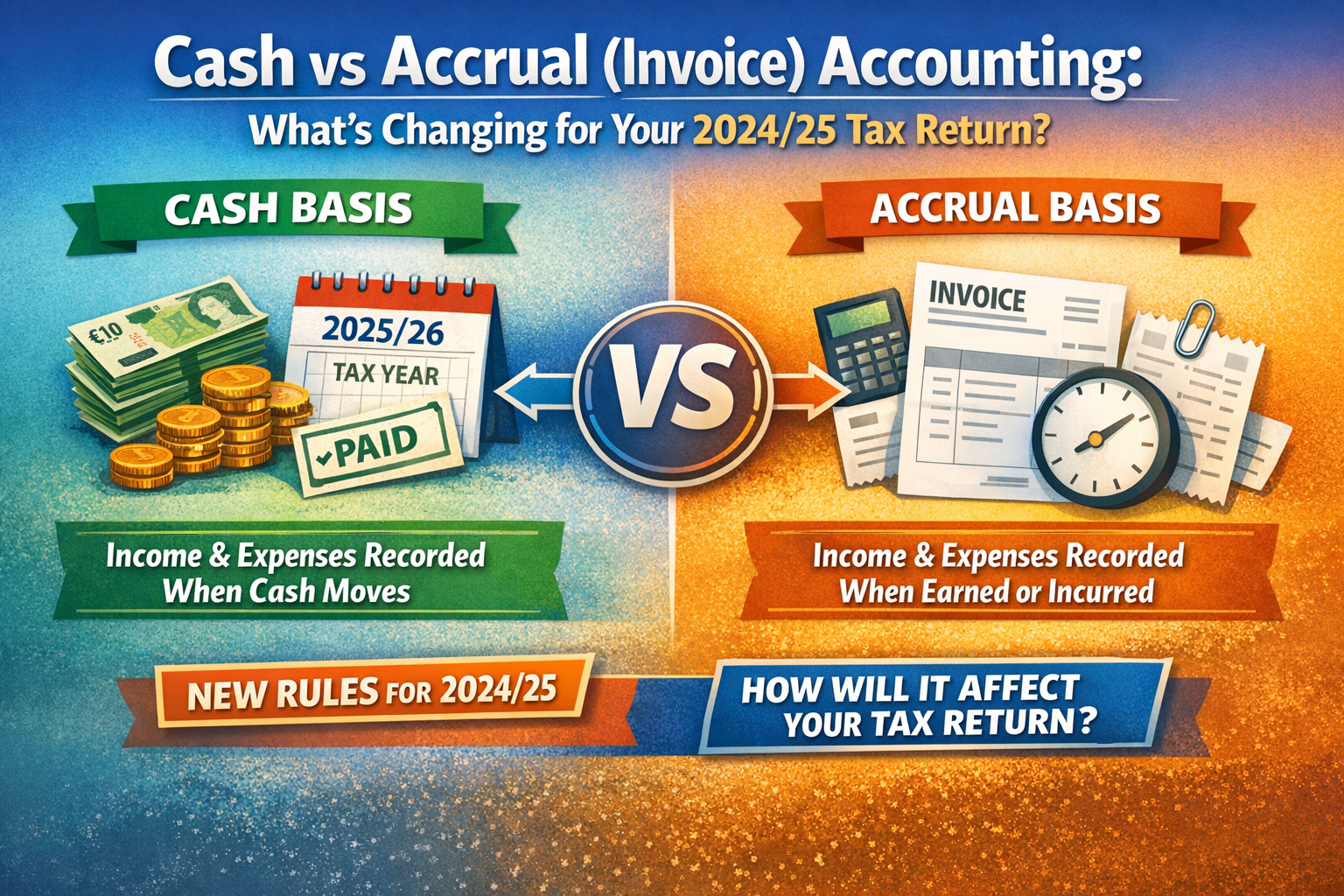

Cash vs Accrual (Invoice) Accounting: What’s Changing for Your 2024/25 [...]

On 26/11/25, Chancellor Rachel Reeves presented her second Budget to [...]

Understanding Payments on Account: What You Need to Know [...]

At Moore Accountancy, we work with many landlords—some who hold [...]