Changes to the Renters’ Rights Bill (2025)

At Moore Accountancy, we work with many landlords—some who hold buy-to-let (BTL) properties personally, and others who hold properties via a limited company special purpose vehicle (SPV).

Both sets of property owners will be affected by the changes introduced by the Renters’ Rights Act 2025.

The former Renters’ Rights Bill achieved Royal Assent on 27/10/25, and is now formally law. While the implementation of the most significant changes will be phased in over time, the Act introduces several key shifts that will impact how landlords operate and interact with tenants.

Below, we have summarised the most notable changes expected to come into effect.

-

Abolishment of Section 21 (“No Fault” Evictions)

Under the new rules, landlords will no longer be able to evict tenants without a valid and established ground for ending a tenancy. This means all evictions must use the revised Section 8 grounds.

Acceptable reasons for possession will include, for example, if you wish to sell the property or if you intend to move yourself or a close family member into the home.

A critical point: If you evict a tenant on the basis that you are selling or moving in, you must then follow through with that action. The Act includes provisions to prevent re-letting or re-marketing the property for a protected period (expected to be 12 months) following the use of these grounds, making you liable for wrongful eviction penalties if you fail to comply.

-

Prohibition of Discrimination Against Families and Benefit Recipients

This is a major change designed to ensure fairer access to housing. The Act makes it illegal for landlords and agents to impose blanket bans on renting to:

- Tenants in receipt of benefits (such as Universal Credit or Housing Benefit), otherwise known as ‘No DSS’ bans.

- Families with children.

This means prospective tenants must be judged on their individual suitability and ability to afford the rent, not simply on their source of income or family status. Landlords can, and should, still carry out standard affordability and referencing checks.

-

Strengthened Rent Repayment Orders and Penalties

If a landlord breaches a tenant’s rights, they may be required to make a rent repayment to the tenant. The Act proposes tougher penalties, including:

- The maximum fine being doubled.

- Repeat offenders automatically receiving the maximum penalty.

- The rules extending to superior landlords—those who ultimately own or control the property, even if a letting or management company is used.

This means both the management company and the property owner could be held liable if tenant rights are breached.

-

Banning Bidding on Tenancies

The Act seeks to make the rental process fairer by prohibiting bidding wars. Landlords will no longer be allowed to solicit, encourage, or accept offers higher than the advertised rent. If they do, they could face rent repayment penalties.

-

Private Rented Sector Database & Ombudsman

Not all changes disadvantage responsible landlords. The Act establishes a new Private Rented Sector Database, designed to help landlords understand their legal obligations and demonstrate compliance more easily. It also introduces a new Ombudsman to resolve disputes faster, preventing small issues from escalating into court action.

This will be particularly useful for “accidental landlords” by providing a clearer, more accessible way to stay compliant in a changing market.

Conclusion

The Renters’ Rights Act 2025 represents one of the most significant updates to rental law in recent years. It aims to strike a balance—offering tenants greater security while helping responsible landlords operate with transparency and confidence.

The implementation of the ban on Section 21, coupled with the new non-discrimination clauses, means that the emphasis will increasingly be on robust tenant vetting and ensuring properties meet standards (including the new Decent Homes Standard, also part of the reforms).

At Moore Accountancy, we’ll continue to monitor the Act’s phased implementation and keep clients informed as specific commencement dates are announced.

Need Guidance on the Upcoming Changes? If you are a landlord and would like tailored advice on how these changes could affect your rental income, bookkeeping, or tax obligations, please get in touch with our team at info@mooreaccountancy.co.uk or call us on 0161 470 7878.

For further information – https://bills.parliament.uk/bills/3764 for the bill at Parliament

News

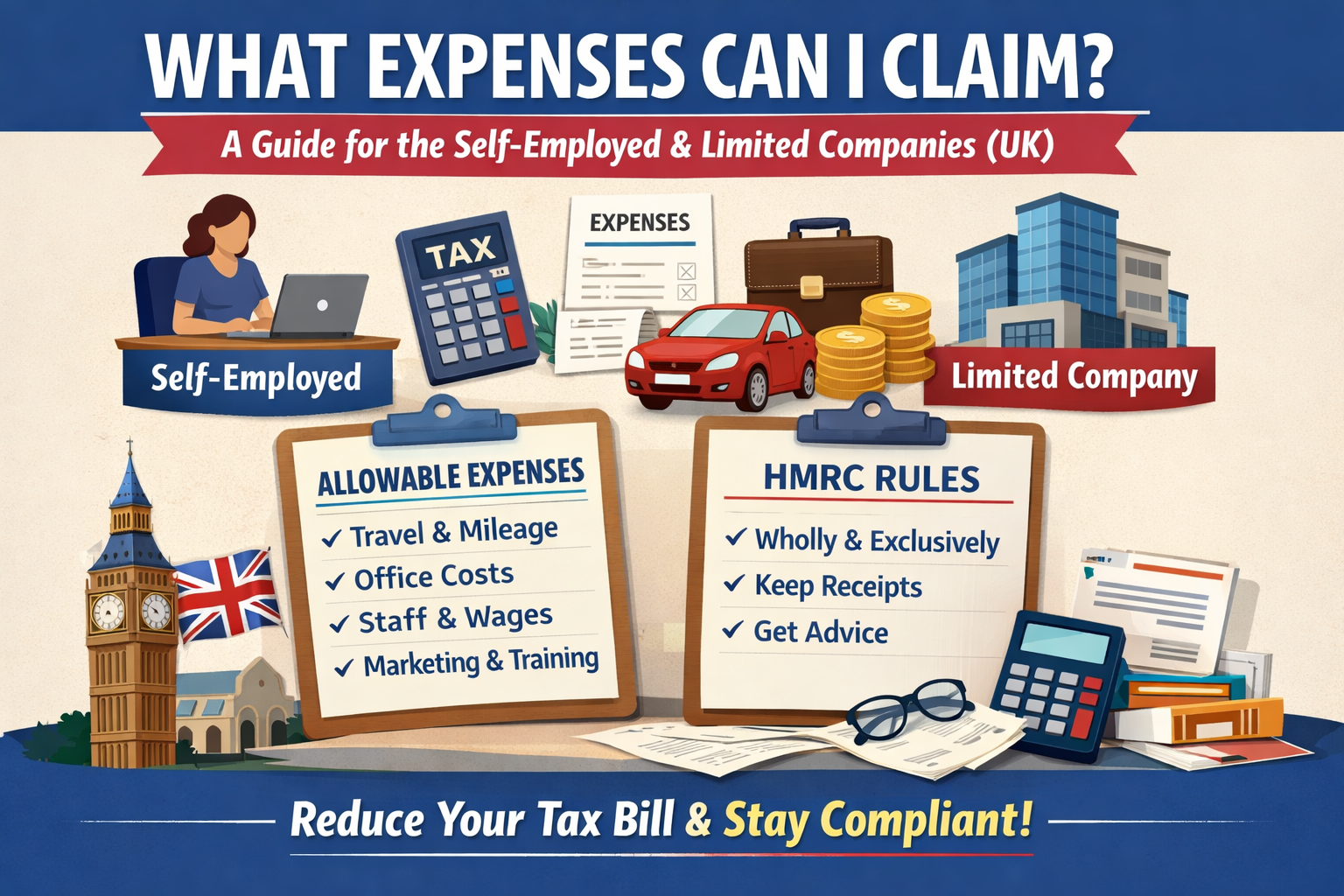

What Expenses Can I Claim? A Guide for the Self-Employed [...]

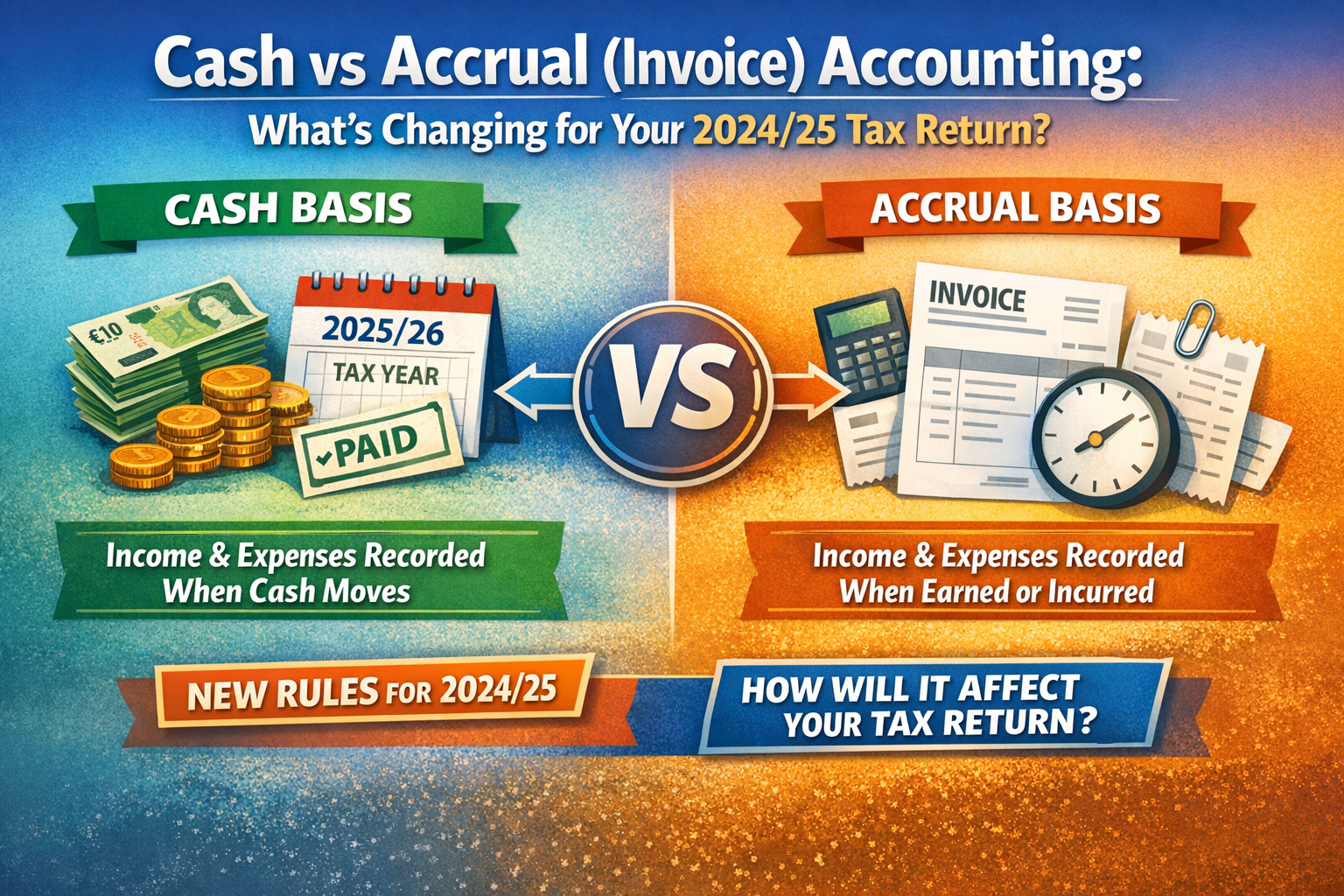

Cash vs Accrual (Invoice) Accounting: What’s Changing for Your 2024/25 [...]

On 26/11/25, Chancellor Rachel Reeves presented her second Budget to [...]

Understanding Payments on Account: What You Need to Know [...]

At Moore Accountancy, we work with many landlords—some who hold [...]