Cash Vs Accruals Accounting Method

Cash vs Accrual (Invoice) Accounting: What’s Changing for Your 2024/25 Tax Return?

Over the past few months, as we have been completing clients’ Self-Assessment Tax Returns (SATR), we have been contacting individuals to confirm whether they would like to use the Cash or Accrual accounting basis.

But what does this actually mean — and why does it matter for your tax return?

What’s the Difference Between Cash and Accrual Accounting?

Cash Accounting (Cash Basis)

Cash accounting records income and expenses when money moves.

Tax is based on when cash is received or paid.

Income Example – Self-employed gardener

- 30th March 2025: Completes a job and issues an invoice for £100

- 10th April 2025: Client pays the invoice

Under the cash basis, the income is recorded on 10th April, when the money arrives.

This means it falls into the 2025/26 tax year.

Expense Example – Using a credit card

- 30th March 2025: You purchase £60 of tools using a credit card

- 10th April 2025: You pay the credit card bill

You can treat the expense as paid either when you make the credit card payment to the supplier (i.e., when you use the card), or when you pay the credit card bill—but you must be consistent in your approach for all such transactions.

The expense can therefore be recorded on 10th April, because that’s when cash leaves your bank, so will be included in the 2025/26 tax year

Or the expense can be recorded on 30th March, because that’s when the credit card “paid transaction” happened, so will be included in the 2024/25 tax year

Accrual Accounting (Traditional Invoice Accounting)

Accrual accounting records income and expenses when they are earned or incurred, not when payment happens.

Income Example – Self-employed gardener

- 1st March 2025: Job completed and invoice raised

- 10th April 2025: Client pays the invoice

The income is recorded on 1st March, when the work was completed and invoiced

This is in the 2024/25 tax year

Expense Example – Using a credit card

- 1st March 2025: Tools bought on a credit card

- 10th April 2025: Card bill is paid

The expense is recorded on 1st March, when the cost was incurred.

Cash vs Accrual Accounting at a Glance

| Feature | Cash Basis | Accrual Basis |

| When income is recorded | When cash is received | When work is completed/invoiced |

| When expenses are recorded | When cash leaves your bank | When the cost is incurred |

| Simplicity | Very simple | More detailed |

| Impact on tax | Tax may reduce in years with slower cashflow | Smoother year-to-year tax reporting |

| Transitional rules | Yes — debtors/creditors adjustments | Yes if switching back |

Why Are Clients Receiving Emails? (Important Rule Changes)

For the current 2024/25 tax year onward, HMRC has changed the default accounting basis for SATR clients.

Sole Traders, Self-Employed Individuals & Partnerships

The new default method is Cash Basis.

If you want to stay on the Accrual Basis, you must actively tell us.

If not, we are required to file your tax return using the cash basis.

Landlords & Individuals With Rental Income

For rental income, the rules are also changing.

The default (and in many cases, mandatory) method is now the Accrual Basis.

This simplifies alignment with standard property accounting practices.

Accrual accounting becomes mandatory if:

- Your gross rental income exceeds £150,000, or

- You are a company, Limited Liability Partnership (LLP), trustee, corporate body, or personal representative.

What You Need to Consider Before Choosing

Choosing the right accounting method can affect:

- Your tax bill

- National Insurance

- High Income Child Benefit Charge

- Your cashflow

- Year-to-year reporting

- Transitional adjustments (debtors, creditors, opening balances)

While the cash basis is often simpler, it is not always the most tax-efficient choice.

If you are unsure, it’s important to get tailored advice.

Need Help Choosing the Right Method?

We’re here to guide you through the changes and make sure your tax return is filed correctly and in the most beneficial way for you.

Call us: 0161 470 7878

Email: info@mooreaccountancy.co.uk

Our team will help you understand your options and make the choice that best suits your circumstances.

News

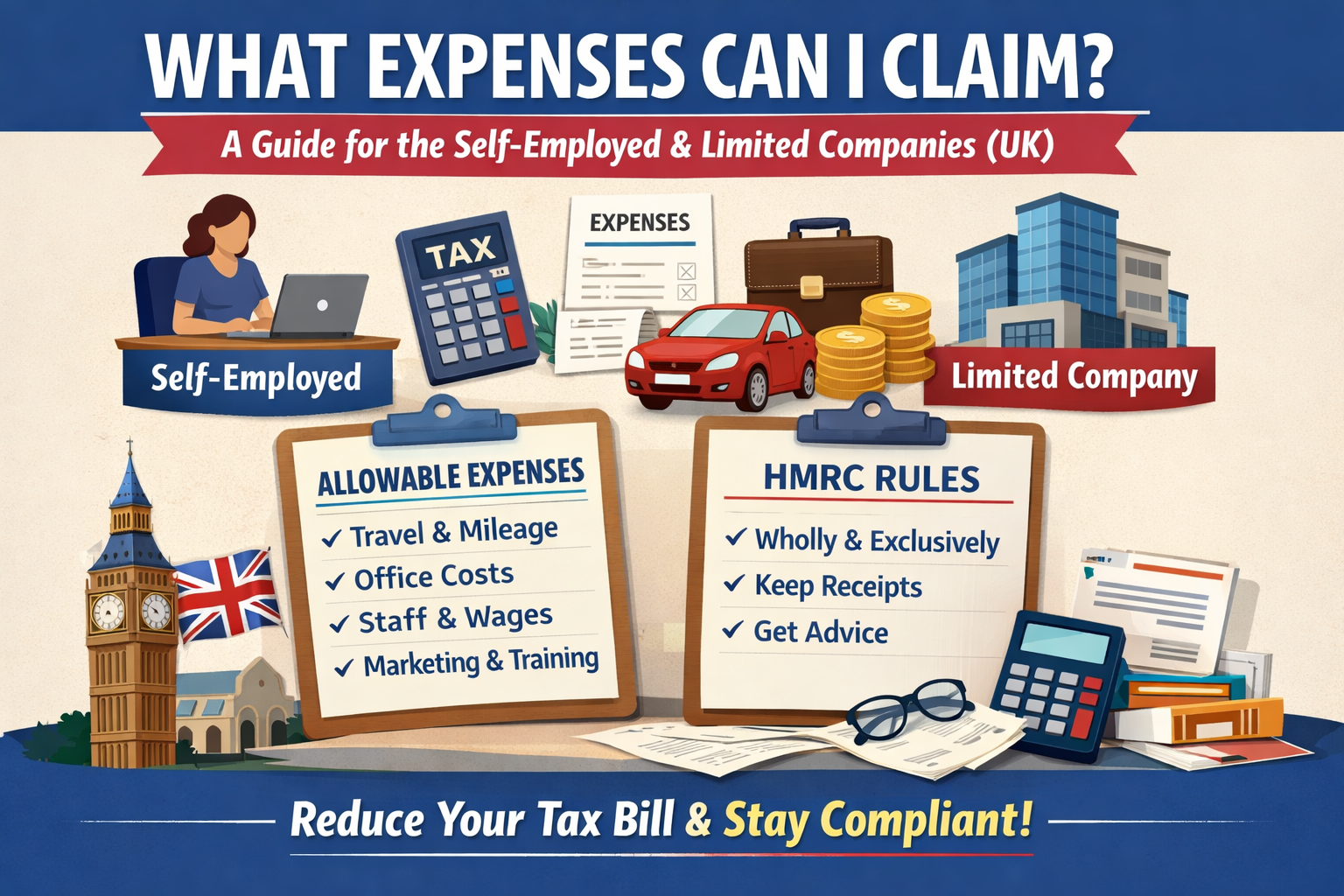

What Expenses Can I Claim? A Guide for the Self-Employed [...]

Cash vs Accrual (Invoice) Accounting: What’s Changing for Your 2024/25 [...]

On 26/11/25, Chancellor Rachel Reeves presented her second Budget to [...]

Understanding Payments on Account: What You Need to Know [...]

At Moore Accountancy, we work with many landlords—some who hold [...]