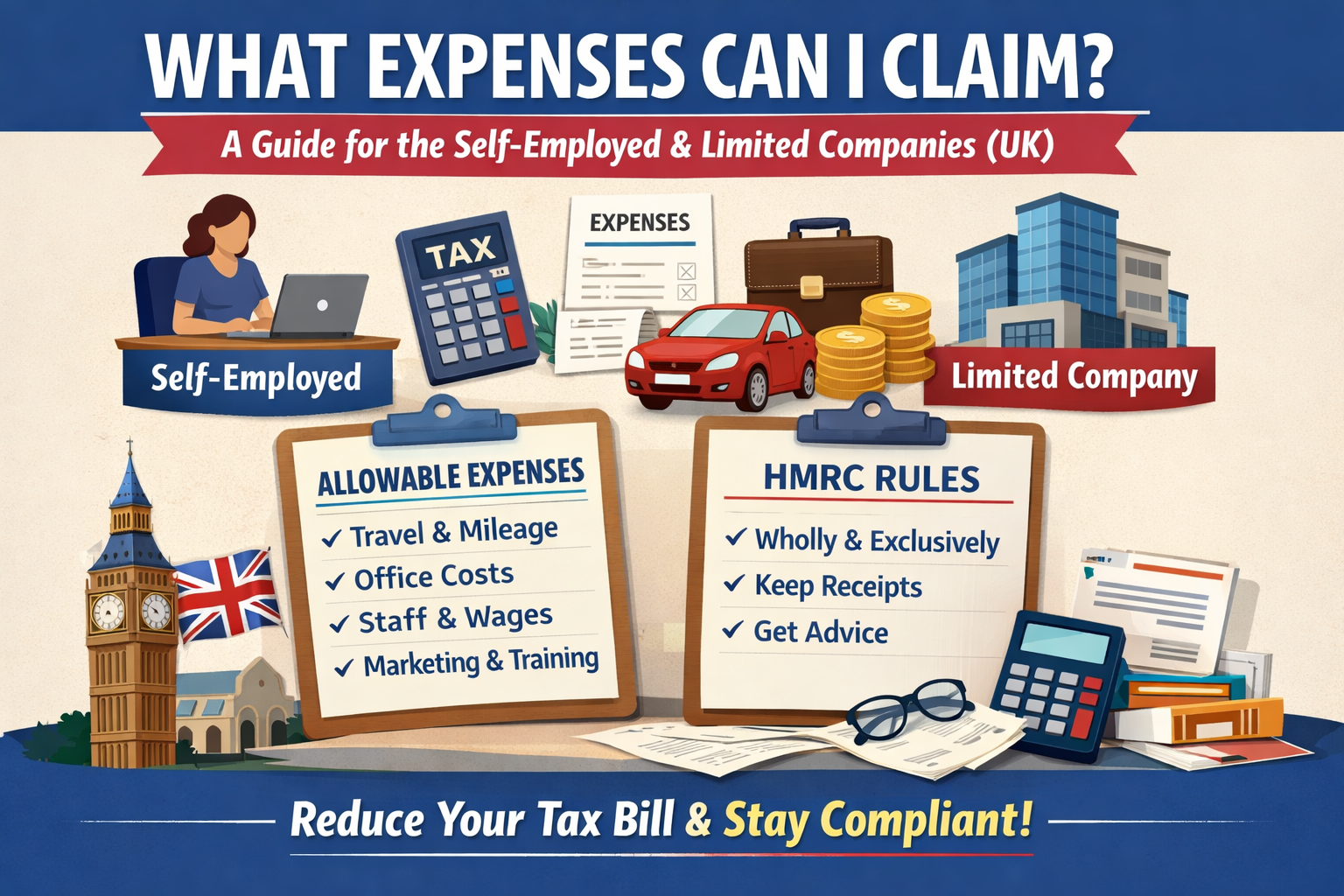

What Expenses Can I Claim? A Guide for the Self-Employed and Limited Companies (UK)

What Expenses Can I Claim? A Guide for the Self-Employed and Limited Companies (UK)

If you’re self-employed or run a limited company, knowing what allowable business expenses you can claim is crucial for reducing your tax bill and staying compliant with HMRC. In this guide, we explain the key rules around allowable expenses, whether you’re completing a self-assessment tax return or running a micro limited company.

Allowable Expenses for the Self-Employed

If you’re a sole trader, the rules are relatively flexible. You can deduct a wide range of expenses from your income before working out your taxable profit, provided they are “wholly and exclusively” for business purposes.

The Apportionment Rule: For items you use for both work and home (like your mobile phone, car, or home utilities), HMRC allows you to apportion the cost. This means you calculate the business-use percentage and claim that specific portion against your tax.

Common examples include:

- Office costs – stationery, phone bills, and home working expenses

- Travel costs – mileage, train fares, parking, and business accommodation

- Clothing – branded uniforms or protective gear (not everyday clothing)

- Staff costs – wages, subcontractor payments, and staff training

- Stock and goods for resale – items purchased to sell on

- Bank and financial charges – including interest on business loans

- Business premises costs – rent, utilities, and maintenance

- Advertising and marketing – including websites, social media, and flyers

- Training courses – if directly related to your current business

What Expenses Can a Limited Company Claim?

For limited companies, the rules are stricter because the company is a separate legal entity from you as the director. HMRC requires that any cost claimed must be “wholly and exclusively” for the purpose of the business. This means the primary reason for the expense must be to generate profit or maintain the company’s operations.

The All-or-Nothing Rule: Generally, an expense must be for the company’s business only. If an expense has a “dual purpose” (both personal and business), HMRC may disallow the entire claim for Corporation Tax relief. Unlike sole traders, you cannot usually apply a fixed percentage to a mixed-use bill.

Structure Matters: To claim mixed-use items like mobile phones or broadband, the contract should ideally be in the company’s name. If it remains in your personal name, you can usually only claim for specific, identifiable business costs (like individual business calls) rather than a portion of the monthly line rental.

Typical allowable expenses include:

- Accountant and legal fees

- Staff wages and employer National Insurance Contributions

- Office supplies and IT equipment

- Rent and utilities for business premises

- Business insurance and professional memberships

- Marketing, advertising, and website costs

- Business-related travel and accommodation

- Training for directors or staff (where related to their current role)

Personal items – such as everyday clothing worn to work – cannot usually be claimed unless they are used exclusively for business purposes (for example, safety equipment or a required uniform).

The Director’s Loan Account (DLA) Trap

If the company pays for a personal item, the cost is typically posted to your Director’s Loan Account. It’s vital to monitor this balance:

- Tax Charges: If your DLA is overdrawn by more than £10,000, it is classed as a “Benefit in Kind.” You may have to pay personal tax on this, and the company will pay National Insurance, unless you pay interest back to the company at HMRC’s official rate.

- Section 455 Tax: If the loan isn’t repaid within nine months of your company’s year-end, the company must pay a 33.75% tax charge (S455 tax) to HMRC. While this is repayable once the loan is cleared, it can tie up significant company cash flow.

Quick Tips for Directors

- Electric Vehicles: For 2025/26, the Benefit in Kind (BiK) rate for fully electric company cars is 3%. While slightly higher than in previous years, it remains a highly tax-efficient way for directors to drive a premium vehicle.

- Training: You can claim for training that maintains or updates your existing skills. Be aware that HMRC is stricter on training for entirely new sectors—ensure the course directly supports your current business goals.

Why It Matters to Get It Right

Claiming expenses incorrectly can sometimes lead to HMRC penalties or unexpected tax bills. To stay on the safe side:

- Keep clear records and receipts for all business purchases

- Avoid claiming personal or partly personal expenses

- Speak to an accountant if you’re unsure whether something is allowable

At Moore Accountancy, we specialise in working with self-employed individuals, micro limited companies, and hospitality businesses. We help our clients stay compliant, maximise their allowable expenses, and understand exactly what they can and can’t claim.

Thinking of Switching Accountants?

If you’re not currently with Moore Accountancy and want peace of mind when it comes to your expenses and tax affairs, we offer a free 30-minute consultation for potential new clients.

Get in touch today and our friendly team will explain how we can support you and your business.

Moore Accountancy

📍 1 Northway, Altrincham, WA14 1NN

📞 0161 470 7878

📧 info@mooreaccountancy.co.uk

🌐 www.mooreaccountancy.co.uk

Tax rules can change and individual circumstances vary. Always seek professional advice before making decisions based on general guidance.

News

What Expenses Can I Claim? A Guide for the Self-Employed [...]

Cash vs Accrual (Invoice) Accounting: What’s Changing for Your 2024/25 [...]

On 26/11/25, Chancellor Rachel Reeves presented her second Budget to [...]

Understanding Payments on Account: What You Need to Know [...]

At Moore Accountancy, we work with many landlords—some who hold [...]