Budget 2017 and the changes for small business

Moore Accountancy were not overly enamoured about “Spreadsheet Phil’s” Budget and it’s effects for our small business clients.

Positives included no negative changes to pensions, £2bn more for social care and a delay in Making Tax Digital (MTD) for small self-employed businesses under the VAT threshold.

Negatives include the increase in Class 4 NICs from 9% to 11% by April 2019 and the reduction of the 0% dividend band from £5k to £2k.

Some of these points are further discussed in our Budget newsletter which can be read here –Tax-Newsletter-UK-March-2017.

If you wish to discuss anything from the budget then please drop us an email at info@mooreaccountancy.co.uk

News

Nobody likes a brown envelope from HMRC, especially one containing [...]

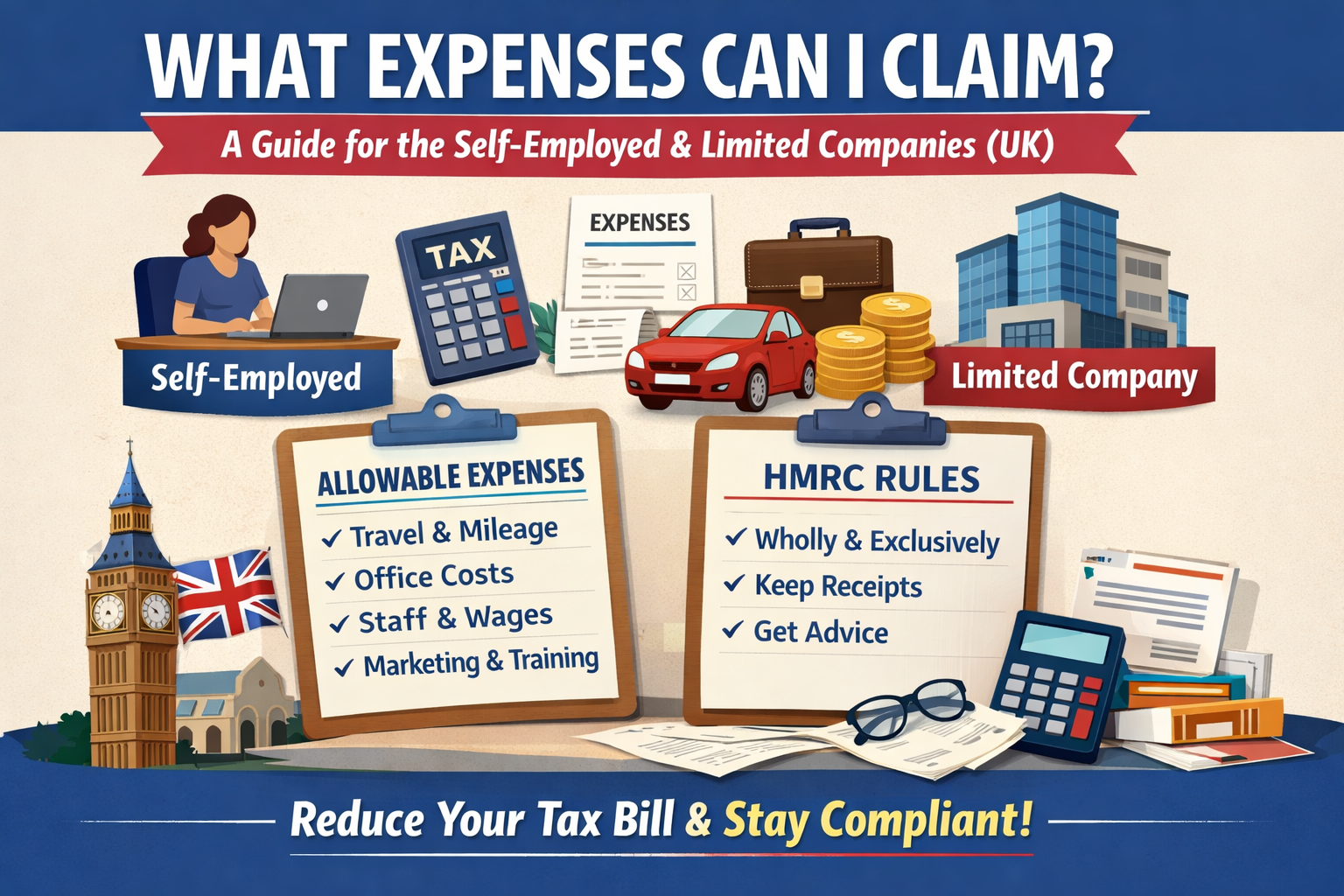

What Expenses Can I Claim? A Guide for the Self-Employed [...]

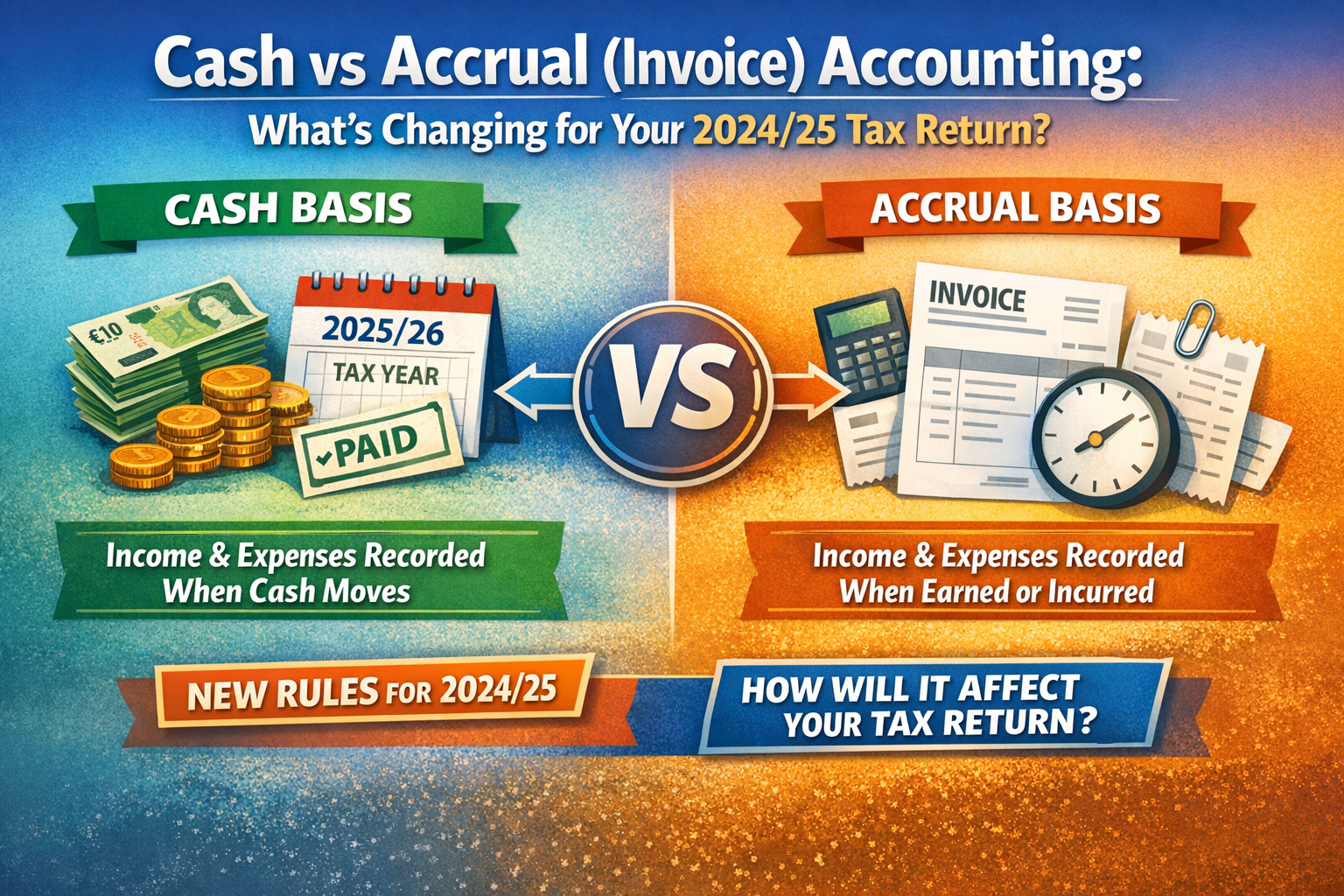

Cash vs Accrual (Invoice) Accounting: What’s Changing for Your 2024/25 [...]

On 26/11/25, Chancellor Rachel Reeves presented her second Budget to [...]

Understanding Payments on Account: What You Need to Know [...]