Use of Home Allowance: What You Can Claim from HMRC

Use of Home Allowance: What You Can Claim from HMRC

If you run your business from home, you may be entitled to claim a portion of your household expenses as tax-deductible costs. HMRC recognises that working from home increases your utility usage and other costs—so the Use of Home (UoH) allowance exists to help you offset some of these expenses.

In this guide, you’ll learn:

- how the Use of Home allowance works,

- what expenses you can claim, and

- the key differences depending on whether you’re self-employed, an employee, or a limited company director.

What Is the Use of Home Allowance?

The Use of Home allowance lets you claim part of your household costs as a business expense. This means you reduce your taxable profit (if you’re self-employed) or get reimbursed by your company (if you’re a director).

The rules vary depending on your situation, so let’s break them down.

If You’re Self-Employed or a Sole Trader

As a sole trader, you can choose between two methods to calculate your Use of Home claim:

- Flat Rate Method

This is the simplest option. HMRC allows you to deduct a flat rate each month, depending on how many hours you work from home.

| Hours Worked per Month | Flat Rate Deduction |

| 25–50 hours | £10 per month |

| 51–100 hours | £18 per month |

| 101+ hours | £26 per month |

Pros: Quick and easy, with no bills to review

Cons: May give a lower claim if you work from home often or have high costs

- Actual Costs Method

This method is more detailed but often results in a higher claim, especially if you use your home for business regularly.

How it works:

- Count the total number of rooms in your home (include kitchen and living rooms, but not hallways or toilets).

- Identify how many rooms you use for business (e.g. 1 out of 10 rooms).

- Add up your eligible household costs (see list below).

- Calculate the business-use portion (e.g. 1/10 of total expenses).

- Adjust for the percentage of time the room is used for business (e.g. 60%).

Example:

- Total claimable expenses: £1,500

- Business-use portion: 1/10 = £150

- Room used 60% for business: £150 × 60% = £90 claim

Important: Don’t claim 100% business use of a room. If HMRC sees it as exclusively a business space, you could lose Capital Gains Tax (CGT) relief when selling your home.

Eligible household costs include:

- Rent or mortgage interest (not capital repayments)

- Council tax

- Utilities (gas, electric, water)

- Internet and phone

- Home insurance (if it covers business equipment)

- Repairs and maintenance

- Cleaning costs

Pros: Usually gives you a larger reclaim

Cons: More admin—gathering bills and calculating percentages

If You’re an Employee or Director

If you’re employed or a company director, the rules are stricter. You can only claim Use of Home expenses if your employment contract states that your home is your permanent place of work.

If you choose to work from home when an office is available, you can’t make a claim.

When you do qualify, you have two options:

- Flat Rate Method

HMRC allows a fixed deduction of £6 per week, no matter how many hours you work from home.

- Actual Costs Method

This uses the same calculation as the sole trader method but there are less eligible expenses.

Eligible costs include:

- Gas

- Electric

- Water

- Internet (only if you have a dedicated work line)

Pros: May be higher than flat rate if your costs are significant

Cons: More paperwork and restricted list of claimable costs

Special Option for Directors: Rental Agreements

As a director, you have another option—you can set up a rental licence agreement with your company. This treats your home office as if it were business premises.

To do this, you need to:

- Draft a commercial rental agreement between you and your company

- Set the rent at no more than market value (consider obtaining an estate agent valuation)

- Seek professional advice when drawing up the agreement

- Record the rent as income and actual costs as expenses on your personal tax return

Pros: Allows your company to cover more of your home-working costs

Cons:

- You must complete a self-assessment tax return each year

- You may need to pay an accountant to handle the return

- Exclusive business use of a room could affect your Capital Gains Tax relief

Final Thoughts

Claiming the Use of Home allowance correctly can save you money, but the best method depends on your circumstances.

- If you’re a sole trader, the actual costs method may give you the biggest tax saving.

- If you’re an employee, you’ll need to check your contract carefully.

- If you’re a director, a rental agreement may be worth exploring with professional advice.

💬 Need help deciding which approach is best for you?

Call us on 0161 470 7878 or email info@mooreaccountancy.co.uk and we’ll guide you through the most tax-efficient method for your situation.

News

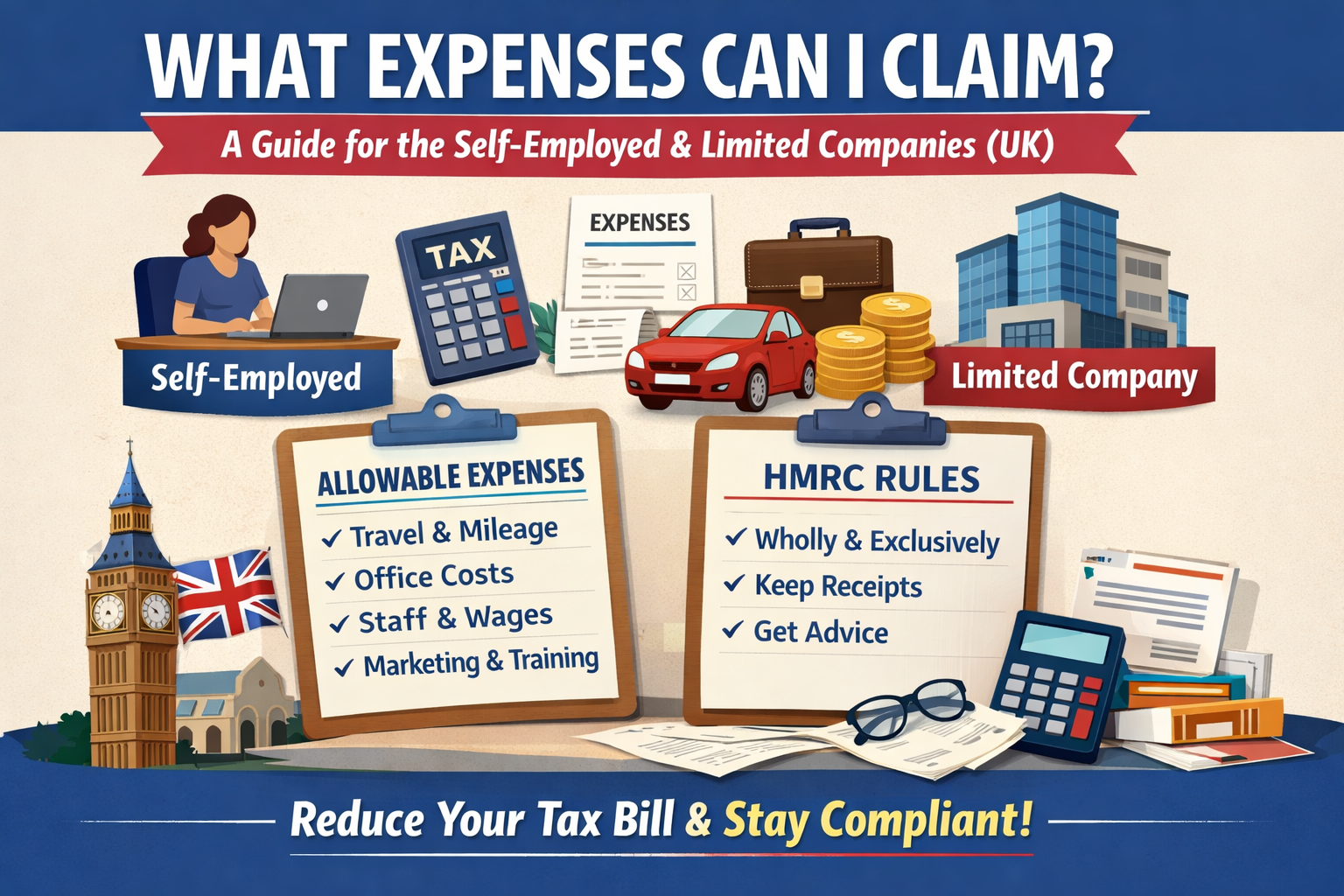

What Expenses Can I Claim? A Guide for the Self-Employed [...]

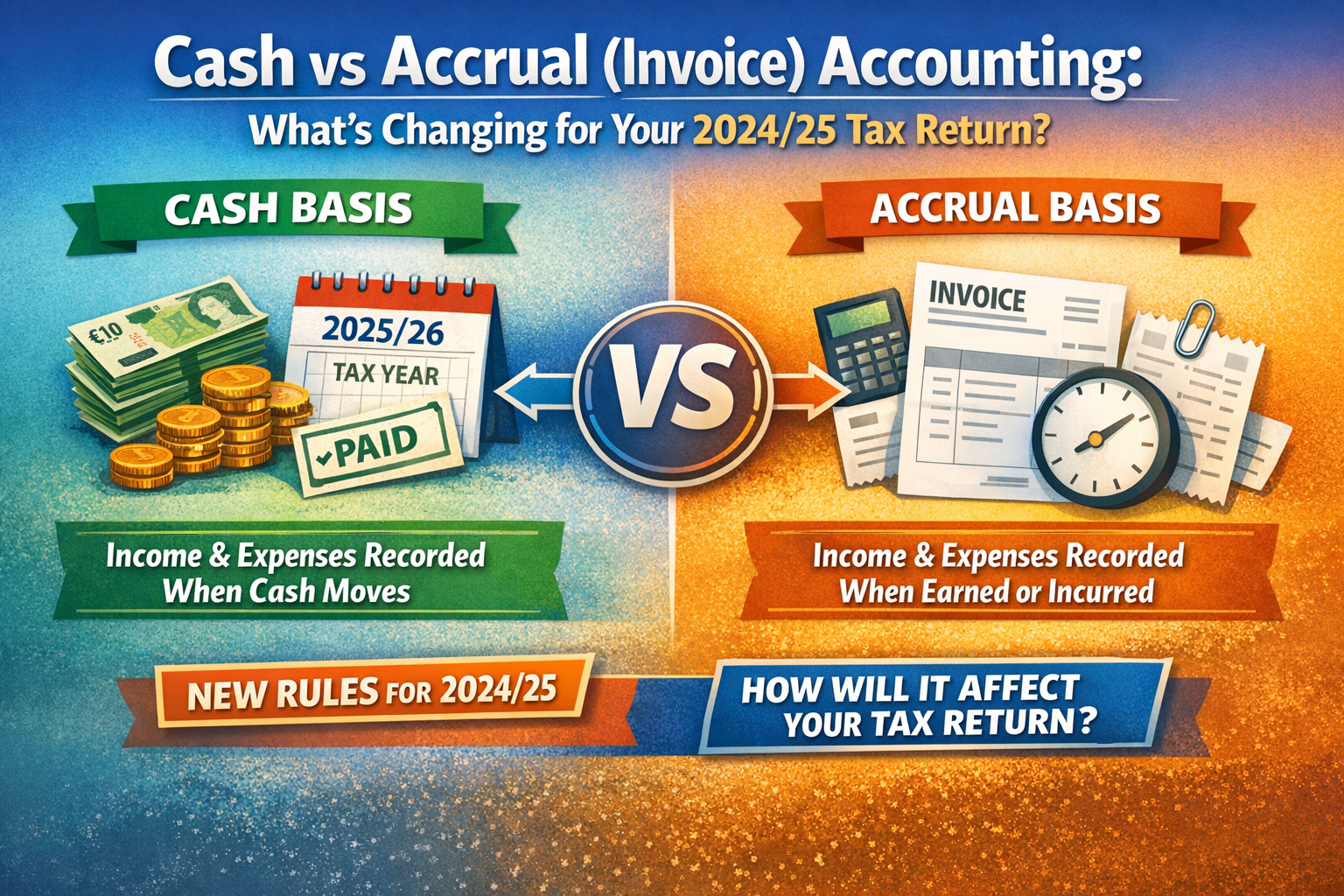

Cash vs Accrual (Invoice) Accounting: What’s Changing for Your 2024/25 [...]

On 26/11/25, Chancellor Rachel Reeves presented her second Budget to [...]

Understanding Payments on Account: What You Need to Know [...]

At Moore Accountancy, we work with many landlords—some who hold [...]